Reimagining On-Chain Liquidity with Quantum Finality

The blockchain industry has long presented itself as a technological revolution—one ostensibly rooted in decentralized infrastructure and cryptographic innovation. But running parallel to this technical evolution is a quieter, yet equally transformative narrative:

A deep and ongoing reinvention of how people trade.

From AMMs and bonding curves to intent-based trading systems, from the ICO wave to DeFi Summer to today's meme-driven PvP markets, crypto has become a global sandbox for designing not just new financial instruments, but entirely new trading relationships and interactive games.

Beyond infrastructure, what's truly unfolding is a shift in how assets are issued, distributed, and redistributed— through a system without centralized intermediaries. But this shift has also revealed a new set of structural challenges.

Trading Innovation, New Friction Issues

On-chain trading doesn't follow the rules of traditional markets. Without centralized liquidity providers, regulatory protections, or guaranteed market makers, every trade becomes a negotiation with uncertainty.

What's left behind is a new class of fragilities—some of which resemble old problems, but amplified in new ways:

- •Slippage becomes more volatile

- •Front-running turns into MEV

- •Price manipulation is no longer illegal—it's automated

These issues carry familiar names—slippage, failed trades, arbitrage, MEV—but in the absence of human enforcement, they evolve from edge cases into systemic features.

And beneath their surface differences, they all share a deeper root:

Liquidity is thin, fragmented, and dangerously predictable.

When Users Compromise, Systems Extract

From pump-and-dump schemes to manipulative token launches, price manipulation on-chain has taken on new forms. Without centralized protections or circuit breakers, users are often left exposed in schemes where prices are orchestrated and exits are planned.

But beyond these headline-grabbing events, a more subtle—and far more common—form of loss plays out every day.

In most trading scenarios, users must explicitly compromise their price preferences just to get a transaction through. Whether on an AMM, aggregator, or intent-based protocol, you widen slippage, adjust your range, or settle for less, all in order to secure liquidity.

These compromises don't disappear quietly. They create:

- •Wider bid-ask spreads

- •Intentional value leakage

- •Predictable patterns that arbitrageurs prey on

In other words, your concession becomes someone else's opportunity.

And this isn't random—it's structural.

The combination of visible intent and scarce liquidity

creates a system where trading becomes extractive by design.

Even well-meaning users, simply trying to execute a fair trade, become sources of arbitrage in a market that rewards predictability over precision.

Introducing Quantum Finality: A Stochastic Settlement Protocol That Protects Trading Intent

To address these issues, we propose a breakthrough at the foundational settlement level of trading —Quantum Finality (QF).

Rather than locking users into a fixed and compromised price exposed to the network, QF allows traders to express a range of acceptable prices, and uses a probabilistic, verifiable process to determine the final price within the range. This structure preserves the expected value of your intent, while introducing just enough uncertainty to prevent your trade from being exploited.

The core idea is simple:

With QF, we don't just optimize execution—we fundamentally shift the trading dynamic:

from deterministic exposure to probabilistic resilience, from compromise to optional precision, and from value leakage to intent protection.

How Quantum Finality Works in a Nutshell: From a Price Range to a Final Price Point

Traditional crypto AMM trading executes at somewhat random prices within user-defined slippage bounds , influenced by market liquidity and arbitrage activities. Yet this mechanism creates hidden problems related to liquidity constraints and intent exploitation.

QF simultaneously addresses both issues through one fundamental shift:

Instead of exposing and agreeing on a fixed price,

buyers and sellers propose and agree on a price range first.

A Simple Example

Alice (Buyer): willing to buy between $1990-$2010 per ETH, with highest willingness being $2000 per ETH.

Bob (Seller): thinks Alice's offer is a reasonable range

They now have an overlapping price range. The final transaction price is unbiasedly determined by QF within this overlapping price range.

Technical Explanation: Stochastic Range Order

A stochastic range order in QF consists of two parts:

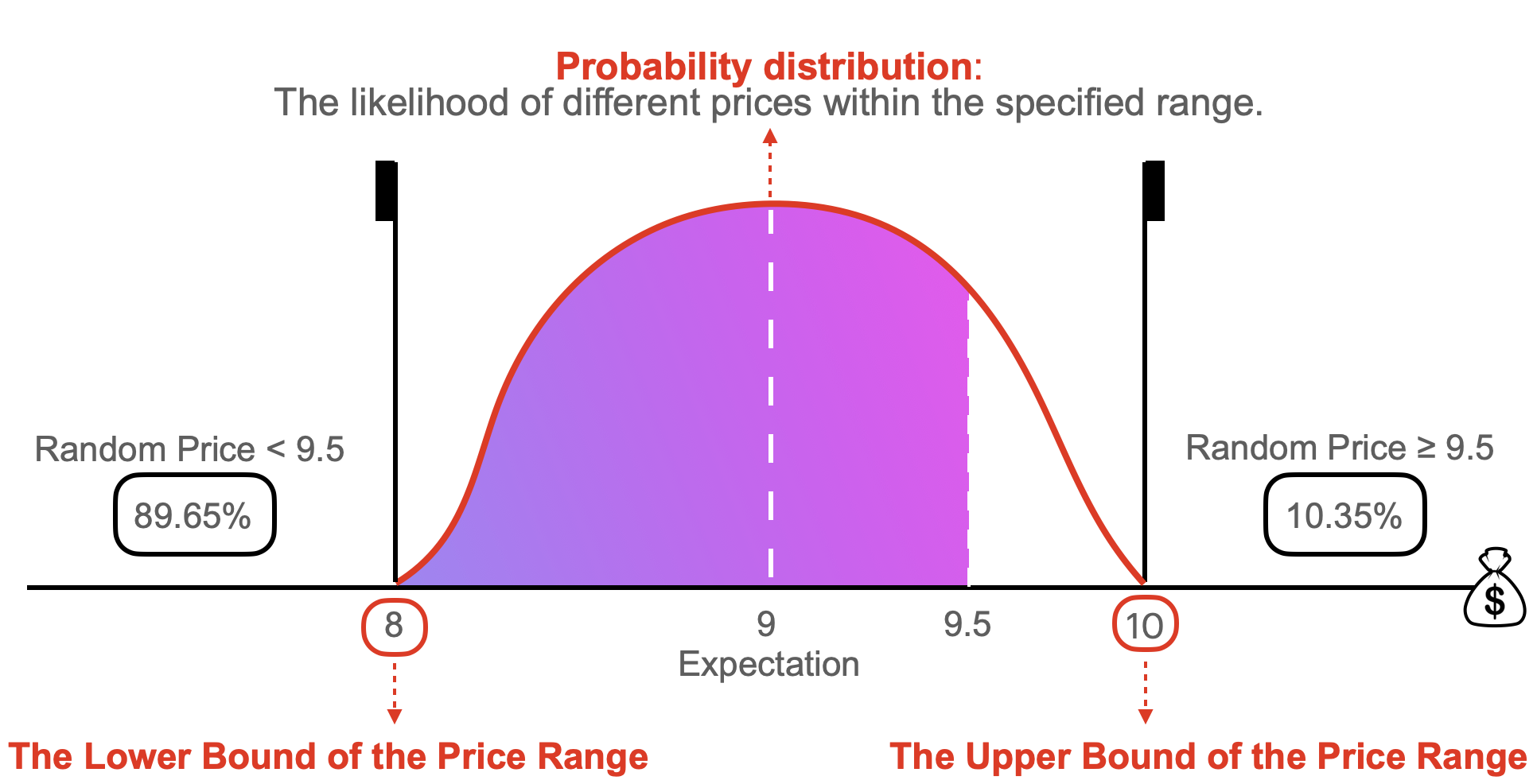

Probability distribution: The likelihood of different prices within the specified range

Price Range:

Users specify a minimum and maximum acceptable price. This reflects their true willingness-to-trade and tolerance for price uncertainty.

Probability Distribution (Optional, but Powerful):

Users can further specify how strongly they prefer certain prices within the range—placing higher likelihood toward their ideal price, while allowing flexibility toward the edges.

Thus, the stochastic range order allows traders to accurately and securely express their intent in a single order.

Finality: Multiple Ways, But Fairness First

Once price ranges are matched to an overlapping price range, QF finalizes the transaction by a random number through sampling from traders' specified probability distributions within that range.

While various settlement methods could be applied, we choose a Verifiable Random Function (VRF) for its proven fairness and strong resistance to MEV and front-running attacks.

Now that we understand how QF works, let's explore the deeper implications:

How does trading via range orders fundamentally reshape the crypto markets?

A Universal Solution For Intent, MEV, Liquidity and More

The reason QF can tackle today's on-chain trading pains so broadly is that it gives people a new, safer language for intent. Trading mechanisms have progressively developed—from market orders broadcasting for immediate execution at the best available price, to limit orders specifying execution only above/below certain prices, to the AMM swaps where you expose exactly two facts: your target price and the max-slippage you'll accept. Those hard numbers turn every order into an open invitation—MEV bots can see the spread, slip in ahead of you, and farm the difference; your "max-slippage" becomes their profit margin.

QF rewrites that disclosure. Instead of a single target with a rigid stop, you broadcast a price range and keep a private probability curve inside it—heavy weight near the price you really want, tapering quickly as the deal gets worse. To pick the final tick, QF can use several methods; today we employ a verifiable-random function (VRF) for its bias-free, MEV-resistant draw. Because the exact price is undecidable until the block is sealed, front-run and sandwich attacks lose their playbook; guessing wrong is suddenly expensive, and most MEV disappears.

This probability distribution simultaneously mitigates routine transactional friction. Participant flexibility is intrinsically encoded, eliminating the necessity for excessive slippage provisions as precautionary measures, while overlapping price ranges create expanded zones of potential transaction clearing. This facilitates increased transaction completion rates, even in markets with limited depth, and the distribution of randomized executions contributes to more accurate price discovery mechanisms rather than inducing extreme volatility events.

Finally, the system reestablishes equitable market conditions for typical participants. Outcomes correlate with declared price preferences rather than execution speed or privileged information flows, resulting in equivalent probabilistic conditions for both novice and sophisticated market participants.

In short:

by turning a rigid slippage into a protected probability distribution,

QF shuts the door on intent-exploitation,

trims the hidden tax of failed or over-slipped orders,

deepens shallow liquidity, and restores fairness

—all through one upgrade in how intent is expressed.

Hybrid with Existing Algorithms

Conventional wisdom posits randomness as antithetical to effective trading strategies; however, empirical evidence from blockchain markets suggests otherwise. The vulnerability lies not in stochasticity but in absolute determinism executed with complete transparency, which provides strategic advantages to sophisticated actors. Consider reflexive bonding curves, where predictable price increments enable algorithmic traders to precisely position themselves at subsequent levels, extract arbitrage opportunities, and exit positions when capital inflows decelerate. The system's failure mechanism stems not from random perturbations but from the perfect predictability of its trajectory.

The Stochastic Settlement Engine (SSE) mitigates these vulnerabilities by maintaining deterministic mechanisms while introducing probabilistic outcomes. Market participants continue to submit algorithmic orders but specify price ranges rather than discrete values. The final settlement price is determined through a verifiable random function (VRF) at block finalization, eliminating the information asymmetries that enable front-running and sandwich attacks. This probabilistic clearing mechanism preserves opportunity equity for all participants regardless of entry sequence and transforms escalating price structures from extraction mechanisms to value-distribution frameworks.

This paradigm shift in settlement methodology catalyzes novel market structures. Spot transactions can incorporate option-style payoff structures at minimal cost without requiring separate derivative instruments. AMMs can distribute liquidity across continuous ranges rather than concentrating it at vulnerable discrete price points, enhancing market depth for less frequently traded assets. Token distribution events can implement equitable price discovery through collective ranges with unified clearing prices determined by VRF.

The underlying computational architecture remains deterministic, but the introduction of probabilistic settlement fundamentally restructures market incentives—transitioning from exploitation-oriented competition to an ecosystem characterized by distributed upside potential, reduced friction, and enhanced innovation capacity.